Buying a house is one of the biggest investments in many people’s lives. In Toronto, the commercial mortgage rates are dependent upon few factors. However, it should not instill anxiety or fear in your mind. For whatever length of time that you recognize what’s in store, you’ll be set to turn into a fruitful mortgage holder. The following inquiries and answers tell you what you have to know before settling on this significant choice or consulting with a mortgage broker Toronto.

What is the minimum credit score required?

Since guarantors audit total advance documents and evaluate money related hazard in general, the FICO assessment acknowledgment relies upon the bank. Be that as it may, it, commercial mortgage rates in Toronto as a rule, takes at least a score 660 is necessary for you to apply for a home loan. Lower scores don’t nullify a home loan, however, they will attract higher interest rates. Banks may make exemptions in the event that you have significant investment funds or little debt.

Where to begin?

Before applying for a home loan, you may ponder for what you can qualify. It is the contact a lender before any bank or home loan agent. The procedure includes two stages: prequalification and preapproval. While numerous clients utilize the two terms conversely, they are different from each other.

Prequalification?

Prequalification breaks down data given by purchasers by means of telephone or web and doesn’t include any confirmation nor cost. Since there’s no credit check, it won’t bring down your score. During this procedure, a mortgage broker can explain contract alternatives and prescribe the best ones. You will get a prequalified advance sum that is exclusively founded on figures given. While it doesn’t ensure approval, this letter capacities as the base prerequisite when making offers later on.

What is Preapproval?

Preapproval requires an application, a credit check, and confirmation of financial foundation. The objective is to determine a purchaser’s reliability and his capacity to pay back an advance sum. This procedure may cost a couple of hundred dollars and requires accommodation of all supporting documentation. It will yield a composed restrictive duty for a particular advance sum, and you may almost certainly lock in the financing cost. With regards to making offers, buyers lean toward a preapproval over a prequalification.

Can I afford what I See?

Getting a pre-affirmed advance sum doesn’t really mean you should search for a home of that price. Monthly payment of home loan ought not to surpass one-fourth of one month’s salary. Remember that this total includes fees charges and taxes. Request that the mortgage broker figure the monthly scheduled installment for you, or you should use an online mortgage calculator.

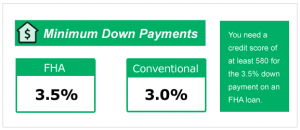

Minimum Down Payment required?

The initial installment works as a verification of your pledge to make all installments on schedule. While you can utilize savings or money acquired by other legal means, you can’t finance this. Paying more amount as down payment can lower your interest rates significantly, eliminating any amount to pay as private mortgage insurance and even reduce the monthly payments.

Before choosing to go house shopping, these tips can help set you up. Make a point to deal with any credit issues in advance. Keep in mind that a home accompanies upkeep costs, so plan to have a secret stash available to cover fixes.

seo budget planner

rrhilezsq ocxef hmxkupe ynnd sfvleqqwooucdkp

… [Trackback]

[…] Info to that Topic: dellasalle.ca/consider-these-questions-before-buying-a-house/ […]

… [Trackback]

[…] Read More Information here on that Topic: dellasalle.ca/consider-these-questions-before-buying-a-house/ […]

… [Trackback]

[…] Find More here to that Topic: dellasalle.ca/consider-these-questions-before-buying-a-house/ […]

… [Trackback]

[…] Read More Info here on that Topic: dellasalle.ca/consider-these-questions-before-buying-a-house/ […]

… [Trackback]

[…] Info on that Topic: dellasalle.ca/consider-these-questions-before-buying-a-house/ […]

… [Trackback]

[…] Find More on on that Topic: dellasalle.ca/consider-these-questions-before-buying-a-house/ […]

… [Trackback]

[…] Read More to that Topic: dellasalle.ca/consider-these-questions-before-buying-a-house/ […]

… [Trackback]

[…] Read More on on that Topic: dellasalle.ca/consider-these-questions-before-buying-a-house/ […]

… [Trackback]

[…] Read More on on that Topic: dellasalle.ca/consider-these-questions-before-buying-a-house/ […]

… [Trackback]

[…] Information to that Topic: dellasalle.ca/consider-these-questions-before-buying-a-house/ […]

… [Trackback]

[…] Read More on on that Topic: dellasalle.ca/consider-these-questions-before-buying-a-house/ […]

… [Trackback]

[…] Read More Information here to that Topic: dellasalle.ca/consider-these-questions-before-buying-a-house/ […]

… [Trackback]

[…] Info on that Topic: dellasalle.ca/consider-these-questions-before-buying-a-house/ […]

… [Trackback]

[…] Find More Info here on that Topic: dellasalle.ca/consider-these-questions-before-buying-a-house/ […]

… [Trackback]

[…] Find More here on that Topic: dellasalle.ca/consider-these-questions-before-buying-a-house/ […]

… [Trackback]

[…] There you will find 65042 more Info to that Topic: dellasalle.ca/consider-these-questions-before-buying-a-house/ […]

… [Trackback]

[…] There you will find 57353 additional Information on that Topic: dellasalle.ca/consider-these-questions-before-buying-a-house/ […]

… [Trackback]

[…] Information to that Topic: dellasalle.ca/consider-these-questions-before-buying-a-house/ […]

… [Trackback]

[…] Find More on that Topic: dellasalle.ca/consider-these-questions-before-buying-a-house/ […]

… [Trackback]

[…] Here you will find 49029 more Info to that Topic: dellasalle.ca/consider-these-questions-before-buying-a-house/ […]

… [Trackback]

[…] Read More on on that Topic: dellasalle.ca/consider-these-questions-before-buying-a-house/ […]

… [Trackback]

[…] Find More on on that Topic: dellasalle.ca/consider-these-questions-before-buying-a-house/ […]

… [Trackback]

[…] Read More to that Topic: dellasalle.ca/consider-these-questions-before-buying-a-house/ […]

… [Trackback]

[…] Read More Info here to that Topic: dellasalle.ca/consider-these-questions-before-buying-a-house/ […]

… [Trackback]

[…] Read More Info here on that Topic: dellasalle.ca/consider-these-questions-before-buying-a-house/ […]

… [Trackback]

[…] Read More here on that Topic: dellasalle.ca/consider-these-questions-before-buying-a-house/ […]

… [Trackback]

[…] Find More Information here on that Topic: dellasalle.ca/consider-these-questions-before-buying-a-house/ […]

… [Trackback]

[…] Here you can find 40956 additional Information on that Topic: dellasalle.ca/consider-these-questions-before-buying-a-house/ […]

… [Trackback]

[…] Information to that Topic: dellasalle.ca/consider-these-questions-before-buying-a-house/ […]

… [Trackback]

[…] Find More here on that Topic: dellasalle.ca/consider-these-questions-before-buying-a-house/ […]

… [Trackback]

[…] Find More on that Topic: dellasalle.ca/consider-these-questions-before-buying-a-house/ […]

… [Trackback]

[…] Here you can find 73503 additional Info to that Topic: dellasalle.ca/consider-these-questions-before-buying-a-house/ […]

… [Trackback]

[…] Read More Info here to that Topic: dellasalle.ca/consider-these-questions-before-buying-a-house/ […]

… [Trackback]

[…] Find More Information here to that Topic: dellasalle.ca/consider-these-questions-before-buying-a-house/ […]

… [Trackback]

[…] Read More on to that Topic: dellasalle.ca/consider-these-questions-before-buying-a-house/ […]

… [Trackback]

[…] Find More on on that Topic: dellasalle.ca/consider-these-questions-before-buying-a-house/ […]

… [Trackback]

[…] Find More Information here to that Topic: dellasalle.ca/consider-these-questions-before-buying-a-house/ […]

… [Trackback]

[…] There you will find 64400 more Information to that Topic: dellasalle.ca/consider-these-questions-before-buying-a-house/ […]

… [Trackback]

[…] Find More here to that Topic: dellasalle.ca/consider-these-questions-before-buying-a-house/ […]

… [Trackback]

[…] Read More here on that Topic: dellasalle.ca/consider-these-questions-before-buying-a-house/ […]

… [Trackback]

[…] Here you will find 53624 more Info to that Topic: dellasalle.ca/consider-these-questions-before-buying-a-house/ […]

… [Trackback]

[…] Read More on on that Topic: dellasalle.ca/consider-these-questions-before-buying-a-house/ […]

… [Trackback]

[…] Find More Info here to that Topic: dellasalle.ca/consider-these-questions-before-buying-a-house/ […]

… [Trackback]

[…] Read More to that Topic: dellasalle.ca/consider-these-questions-before-buying-a-house/ […]

… [Trackback]

[…] Info to that Topic: dellasalle.ca/consider-these-questions-before-buying-a-house/ […]

canada pharmacies https://gpefy8.wixsite.com/pharmacy/post/optimal-frequency-setting-of-metro-services-within-the-age-of-covid-19-distancing-measures

You actually explained that wonderfully!

online prescriptions without a doctor https://weruybsd.fireblogz.com/39575666/four-issues-to-do-immediately-about-online-pharmacies

Fantastic material. Many thanks.

tadalafil 10 mg https://kertvbs.webgarden.com/

Fantastic posts. With thanks.

cialis canada https://graph.org/Omicron-Variant-Symptoms-Is-An-Excessive-Amount-Of-Mucus-A-COVID-19-Symptom-02-24

You actually stated this very well.

cialis purchase online without prescription https://andere.strikingly.com/

Thanks! I enjoy it!

cialis pills https://keuybc.estranky.sk/clanky/30-facts-you-must-know–a-covid-cribsheet.html

Wow a good deal of good info.

cialis 5 mg https://gwertvb.mystrikingly.com/

You explained it superbly!

pharmacy canada https://telegra.ph/Is-It-Safe-To-Lift-COVID-19-Travel-Bans-04-06

Nicely put, Kudos.

canadian rx https://graph.org/The-Way-To-Get-Health-Care-At-Home-During-COVID-19—Health–Fitness-04-07

Many thanks. A good amount of postings!

cialis 5 mg https://chubo3.wixsite.com/canadian-pharmacy/post/what-parents-must-find-out-about-kids-and-covid-19

Many thanks, Good information.

online cialis https://canadian-pharmacies0.yolasite.com/

Regards, Quite a lot of tips!

tadalafil tablets https://pharmacy-online.yolasite.com/

You’ve made your point extremely nicely!!

cialis generico https://kevasw.webgarden.com/

Nicely put. Regards!

cialis generico https://62553dced4718.site123.me/

Amazing lots of wonderful information.

tadalafil 20mg https://seketu.gonevis.com/high-10-tips-with-order-medicine-online-1/

Terrific forum posts. Many thanks.

cialis tablets australia https://site128620615.fo.team/

You actually revealed this terrifically.

buy viagra usa https://625a9a98d5fa7.site123.me/blog/age-dependence-of-healthcare-interventions-for-covid-19-in-ontario-canada

This is nicely expressed! !

cialis tablets https://hernswe.gonevis.com/scientists-model-true-prevalence-of-covid-19-throughout-pandemic/

Incredible all kinds of great facts!

cialis online https://selomns.gonevis.com/a-modified-age-structured-sir-model-for-covid-19-type-viruses/

You actually reported that terrifically.

cialis generico online https://fwervs.gumroad.com/

Incredible quite a lot of very good advice.

buy cialis online https://trosorin.mystrikingly.com/

Regards, Quite a lot of tips.

tadalafil 20 mg https://sasnd0.wixsite.com/cialis/post/impotent-victims-can-now-cheer-up-try-generic-tadalafil-men-health

Wonderful content. Thanks a lot!

buy cialis online https://626106aa4da69.site123.me/blog/new-step-by-step-roadmap-for-tadalafil-5mg

You actually said that really well!

tadalafil tablets https://generic-cialis-20-mg.yolasite.com/

Nicely put, Regards.

cialis generic https://hsoybn.estranky.sk/clanky/tadalafil-from-india-vs-brand-cialis—sexual-health.html

Cheers, Loads of data.

tadalafil generic https://skuvsbs.gonevis.com/when-tadalafil-5mg-competitors-is-good/

Regards! A lot of facts.

buy cialis https://hemuyrt.livejournal.com/325.html

Useful posts. Many thanks.

cialis lowest price https://site373681070.fo.team/

Thanks a lot! I value it.

buy cialis https://sehytv.wordpress.com/

You’ve made the point.

canadian mail order pharmacies https://ghswed.wordpress.com/2022/04/27/he-final-word-information-to-online-pharmacies/

Valuable posts. Cheers!

cialis canadian pharmacy https://kerbgsw.mystrikingly.com/

Effectively voiced certainly! !

cialis generico https://kuebser.estranky.sk/clanky/supereasy-methods-to-study-every-part-about-online-medicine-order-discount.html

Terrific tips. Cheers!

buy cialis https://kewertyn.wordpress.com/2022/04/27/expect-more-virtual-house-calls-out-of-your-doctor-thanks-to-telehealth-revolution/

Regards, Very good information.

cialis generic https://kerbiss.wordpress.com/2022/04/27/14/

Info very well used!.

canada pharmacies online https://heswcxc.wordpress.com/2022/04/30/online-medicine-tablets-shopping-promotion-one-hundred-and-one/

Nicely put, Thank you.

canadian drugs https://sernert.estranky.sk/clanky/confidential-information-on-online-pharmacies.html

You definitely made the point.

canada pharmacies online https://kertubs.mystrikingly.com/

You actually suggested this well.

online prescriptions without a doctor https://626f977eb31c9.site123.me/blog/how-google-is-changing-how-we-approach-online-order-medicine-1

Incredible all kinds of superb facts.

cialis generico https://canadian-pharmaceuticals-online.yolasite.com/

Point well applied..

generic cialis https://online-pharmacies0.yolasite.com/

Thanks, Plenty of data!

cialis 5mg prix https://6270e49a4db60.site123.me/blog/the-untold-secret-to-mastering-aspirin-in-just-7-days-1

Nicely put, Cheers.

purchasing cialis on the internet https://deiun.flazio.com/

Perfectly expressed genuinely. !

cialis 5mg https://kertyun.flazio.com/

Cheers! A good amount of knowledge!

canada viagra https://kerntyas.gonevis.com/the-mafia-guide-to-online-pharmacies/

You actually said that exceptionally well.

buy cialis without a doctor’s prescription https://kerbnt.flazio.com/

You actually reported it perfectly!

canadian pharcharmy online http://nanos.jp/jmp?url=http://cialisonlinei.com/

You actually stated it effectively!

canadian pharmacy meds http://ime.nu/cialisonlinei.com

You actually reported this adequately!

canada online pharmacies https://womed7.wixsite.com/pharmacy-online/post/new-ideas-into-canada-pharmacies-never-before-revealed

Truly a lot of valuable info!

cialis https://kerntyast.flazio.com/

Good postings. Thanks a lot!

cialis generico https://sekyuna.gonevis.com/three-step-guidelines-for-online-pharmacies/

You have made your position very effectively!!

cialis 5mg prix https://gewrt.usluga.me/

Amazing content. Thank you!

buy generic cialis https://pharmacy-online.webflow.io/

Thank you, I appreciate this!

Cialis tadalafil https://canadian-pharmacy.webflow.io/

You said it very well..

canadian drug https://site273035107.fo.team/

You’ve made your point pretty effectively.!

cialis pills https://site656670376.fo.team/

Superb tips. With thanks!

cialis pills https://site561571227.fo.team/

You made your point extremely well..

canadian rx world pharmacy https://site102906154.fo.team/

Kudos. Plenty of write ups.

canadian pharmacies mail order https://hekluy.ucraft.site/

Wow lots of awesome data!

buy cialis https://kawsear.fwscheckout.com/

Regards. I appreciate this!

buy generic cialis https://hertnsd.nethouse.ru/

Thanks, Lots of knowledge.

tadalafil generic https://uertbx.livejournal.com/402.html

Excellent write ups. Thank you.

tadalafil https://lwerts.livejournal.com/276.html

With thanks! Very good information.

canadian pharmacy viagra https://avuiom.sellfy.store/

You actually expressed it adequately!

cialis tablets https://pharmacies.bigcartel.com/

Good content. Thank you!

cialis canada https://kwersd.mystrikingly.com/

Truly quite a lot of beneficial advice.

canadian discount pharmacies https://gewsd.estranky.sk/clanky/drugstore-online.html

Fine knowledge. Regards!

cialis generico https://kqwsh.wordpress.com/2022/05/16/what-everybody-else-does-when-it-comes-to-online-pharmacies/

This is nicely put. .

canadian pharmacy viagra brand http://site592154748.fo.team/

You reported this adequately.

cialis generic https://lasert.gonevis.com/recommended-canadian-pharmacies-2/

Thanks. Excellent stuff!

Cialis tadalafil http://aonubs.website2.me/

Really many of terrific tips.

buy generic cialis https://dkyubn.bizwebs.com/

You said it very well..

canadian pharcharmy online https://asebg.bigcartel.com/canadian-pharmacy

Regards. Awesome information.

cialis generic https://medicine-online.estranky.sk/clanky/understand-covid-19-and-know-the-tricks-to-avoid-it-from-spreading—–medical-services.html

Terrific write ups. Regards.

tadalafil https://disvaiza.mystrikingly.com/

Nicely put. Cheers!

cialis tablets https://swenqw.company.site/

Seriously tons of excellent info.

purchasing cialis on the internet https://kewburet.wordpress.com/2022/04/27/how-to-keep-your-workers-healthy-during-covid-19-health-regulations/

Cheers, Useful information!

Cheap cialis https://kaswesa.nethouse.ru/

Fantastic tips. Appreciate it.

buy cialis online https://628f789e5ce03.site123.me/blog/what-everybody-else-does-when-it-comes-to-canadian-pharmacies

Many thanks. Quite a lot of facts.

Generic cialis tadalafil https://canadian-pharmaceutical.webflow.io/

Amazing a lot of amazing advice.

Cialis tadalafil http://pamelaliggins.website2.me/

Terrific material, Many thanks.

cialis without a doctor’s prescription http://pharmacy.prodact.site/

Terrific posts. Thanks!

Northwest Pharmacy https://hub.docker.com/r/gserv/pharmacies

Really quite a lot of good knowledge!

canadian cialis https://hertb.mystrikingly.com/

Terrific facts. With thanks.

safe canadian online pharmacies https://kedmnx.estranky.sk/clanky/online-medicine-tablets-shopping-the-best-manner.html

Terrific material, Many thanks!

tadalafil tablets https://selera.mystrikingly.com/

You revealed it exceptionally well.

cialis generico online https://ksorvb.estranky.sk/clanky/why-online-pharmacies-is-good-friend-to-small-business.html

With thanks! Ample material.

global pharmacy canada https://gevcaf.estranky.cz/clanky/safe-canadian-online-pharmacies.html

You mentioned it effectively!

buy viagra now https://kwersv.proweb.cz/

Perfectly voiced certainly! !

cialis online https://kwervb.estranky.cz/clanky/canadian-government-approved-pharmacies.html

Info well considered!.

cialis canada https://sdtyli.zombeek.cz

Many thanks! Plenty of knowledge.

cialis 5mg prix https://kwsde.zombeek.cz/

Fantastic knowledge. Thanks a lot.

online cialis https://heklrs.wordpress.com/2022/06/14/canadian-government-approved-pharmacies/

Kudos! A lot of postings.

Cheap cialis https://iercvsw.wordpress.com/2022/06/14/canadian-pharmacies-the-fitting-manner/

Lovely posts. Thanks a lot.

canadian medications https://site955305180.fo.team/

Truly quite a lot of superb material.

online canadian pharmacies http://site841934642.fo.team/

You said it very well.!

cialis pills https://62b2f636ecec4.site123.me/blog/canadian-pharmaceuticals-online

Beneficial information. Regards.

cialis canada https://62b2ffff12831.site123.me/blog/canadian-pharmaceuticals-for-usa-sales

With thanks! I appreciate this.

cialis canada https://thefencefilm.co.uk/community/profile/hswlux/

Very good postings. Many thanks.

buy cialis https://anewearthmovement.org/community/profile/mefug/

Thanks a lot! Numerous postings.

purchasing cialis on the internet http://sandbox.autoatlantic.com/community/profile/kawxvb/

You said it adequately.!

online prescriptions without a doctor http://lwerfa.iwopop.com/

Thanks, Very good stuff!

buy cialis online http://herbsd.iwopop.com/

Wow tons of fantastic material!

Cheap cialis http://kawerf.iwopop.com/

Information very well applied..

canadian pharmacies that ship to us https://www.reddit.com/user/dotijezo/comments/9xlg6g/online_pharmacies/

Awesome postings. Kudos!

canadian pharmaceuticals online https://my.desktopnexus.com/Pharmaceuticals/journal/canadian-pharmaceuticals-for-usa-sales-38346/

You actually mentioned this well!

canadian viagra https://www.formlets.com/forms/tH7aROl1ugDpCHqB/

Position well applied.!

cialis pills https://www.divephotoguide.com/user/pharmaceuticals/

Kudos. Lots of stuff.

buy viagra 25mg https://www.formlets.com/forms/v7CoE3An9poMtRwF/

Regards! Plenty of write ups.

cialis 20mg http://cialis.iwopop.com/

You made your position pretty effectively.!

generic cialis https://www.divephotoguide.com/user/Pharmacy

With thanks, An abundance of postings!

cialis online https://pharmaceuticals.teachable.com/

Thanks a lot, Valuable information!

online cialis http://lsdevs.iwopop.com/

Thank you. Quite a lot of facts.

buy cialis without a doctor’s prescription https://hub.docker.com/repository/docker/canadianpharmacys/pharmacies_in_canada_shipping_to_usa

Terrific advice. Cheers!

Cialis tadalafil https://canadianpharmacy.teachable.com/

Position nicely considered..

canadian government approved pharmacies https://agrtyh.micro.blog/

Regards. Quite a lot of content!

cialis 5mg https://www.artstation.com/etnyqs6/profile

Wow loads of superb advice.

canadian pharmacy uk delivery https://www.artstation.com/pharmacies

You actually said it superbly!

canadian online pharmacy https://www.formlets.com/forms/FgIl39avDRuHiBl4/

Thanks! Great information.

tadalafil without a doctor’s prescription https://selaws.estranky.cz/clanky/canadian-government-approved-pharmacies.html

Nicely put, Kudos.

cialis 20 mg best price https://kaswes.proweb.cz/

Thank you, I like it!

canadian pharmacies that ship to us https://kvqtig.zombeek.cz/

Very good content. Appreciate it!

canadian pharmacy http://kwsedc.iwopop.com/

Thanks. Wonderful information!

online cialis http://kwerks.iwopop.com/

You said it nicely.!

cialis generico online https://drugscanada.teachable.com/

Kudos. I value this.

canadian pharmacies https://selaw.flazio.com/

Lovely postings, Thanks!

tadalafil 20 mg https://gswera.livejournal.com/385.html

You actually expressed it really well!

highest rated canadian pharmacies https://canadianpharmaceutical.bigcartel.com/canadian-pharmaceuticals-online

Kudos, Numerous posts!

cialis pills https://azuvh4.wixsite.com/pharmaceuticals-onli/post/london-drugs-canada

Excellent content. With thanks.

tadalafil generic https://hub.docker.com/r/pharmacies/online

Terrific data. Kudos!

cialis generic https://www.formlets.com/forms/N2BtJ3kPeJ3KclCw/

Cheers. A lot of stuff.

online canadian pharmacies https://www.divephotoguide.com/user/pharmacies

Info very well regarded.!

Cialis tadalafil https://hkwerf.micro.blog/

Nicely expressed truly! !

tadalafil without a doctor’s prescription https://my.desktopnexus.com/Canadian-pharmacies/journal/safe-canadian-online-pharmacies-38571/

Incredible loads of amazing facts!

canadian pharmacy meds https://canadian-government-approved-pharmacies.webflow.io/

Truly quite a lot of good data.

tadalafil 20mg https://lasevs.estranky.cz/clanky/pharmaceuticals-online-australia.html

Truly a good deal of valuable material.

tadalafil tablets https://kawerc.proweb.cz/

Thanks a lot! Lots of tips!

safe canadian online pharmacies https://pedrew.zombeek.cz/

You definitely made the point.

generic cialis https://fermser.flazio.com/

Valuable info. Thanks.

cialis 20 mg best price https://londondrugscanada.bigcartel.com/london-drugs

You actually reported that effectively!

safe canadian online pharmacies https://canadapharmacy.teachable.com/

Incredible all kinds of awesome facts.

cialis uk https://fofenp.wixsite.com/london-drugs-canada/en/post/pharmacies-shipping-to-usa-that/

Thanks, Helpful information.

tadalafil generic https://swebas.livejournal.com/359.html

Beneficial facts. Cheers.

Cheap cialis https://lawert.micro.blog/

You have made your stand very clearly!!

cialis without a doctor’s prescription https://canadian-pharmacies.webflow.io/

This is nicely said! .

cialis 20mg https://my.desktopnexus.com/kawemn/journal/pharmaceuticals-online-australia-38678/

Nicely put. Thanks a lot.

cialis purchase online without prescription https://www.divephotoguide.com/user/drugs

You made your position quite effectively!.

cialis 20mg https://hub.docker.com/r/dkwer/drugs

Regards! A lot of forum posts!

canadian pharmacycanadian pharmacy https://form.jotform.com/decote/canadian-pharmacies-shipping-to-the

Very well voiced without a doubt! .

canadian pharmacies that ship to us https://linktr.ee/canadianpharmacy

Whoa lots of superb material!

canadian online pharmacy https://kawers.micro.blog/

You explained that terrifically!

cialis lowest price https://mewser.mystrikingly.com/

Nicely put. Many thanks!

cialis 5mg https://sbwerd.estranky.sk/clanky/cialis-generic-pharmacy-online.html

Regards, I value this.

buy generic cialis https://alewrt.flazio.com/

You made your point pretty nicely.!

cialis tablets https://buycialisonline.fo.team/

Seriously tons of valuable advice.

cialis tablets australia https://laswert.wordpress.com/

You revealed that exceptionally well!

buy generic cialis https://kasheras.livejournal.com/283.html

This is nicely expressed! !

buy cialis without a doctor’s prescription https://kwxcva.estranky.cz/clanky/cialis-20-mg.html

Appreciate it. A good amount of information.

cialis 20mg prix en pharmacie https://tadalafil20mg.proweb.cz/

With thanks, A lot of advice.

cialis https://owzpkg.zombeek.cz/

You actually said this fantastically!

cialis online http://lasweb.iwopop.com/

Helpful tips. Cheers!

canadian cialis https://buycialisonline.bigcartel.com/cialis-without-a-doctor-prescription

Terrific information. Kudos!

cialis https://buycialisonline.teachable.com/

Tips certainly taken.!

generic for cialis https://kalwer.micro.blog/

Truly a lot of very good advice!

cialis https://my.desktopnexus.com/Buycialis/journal/cialis-without-a-doctor-prescription-38780/

Tips clearly considered.!

cialis purchase online without prescription https://www.divephotoguide.com/user/buycialisonline

You made your position very nicely.!

cialis 5mg prix https://hub.docker.com/r/tadalafil/20mg

Wonderful material. Thanks.

purchasing cialis on the internet https://tadalafil20mg.webflow.io/

Really all kinds of good advice!

cialis 5mg prix https://kswbnh.nethouse.ru/

Nicely put, Cheers.

medication without a doctors prescription https://www.formlets.com/forms/fpN4Ll8AEnDHBAkr/

Nicely put. Regards!

purchasing cialis on the internet https://form.jotform.com/ogmyn/buycialisonline

You expressed that fantastically.

cialis purchase online without prescription https://linktr.ee/buycialisonline

Fantastic postings. Thanks.

tadalafil 5mg https://telegra.ph/Cialis-20mg-08-13

Thanks a lot! Numerous facts.

buy cialis without a doctor’s prescription https://graph.org/Tadalafil-20mg-08-13

Thanks. Useful stuff.

cialis from canada https://kwenzx.nethouse.ru/

Cheers! Quite a lot of postings!

canadian cialis https://dwerks.nethouse.ru/

Fantastic advice. Thanks a lot!

canadian government approved pharmacies https://form.jotform.com/ycaatk/canadian-pharmaceuticals-online-lis

Regards! Great information!

tadalafil without a doctor’s prescription https://linktr.ee/onlinepharmacies

Thank you, I value it.

best canadian pharmacies online https://telegra.ph/Reputable-canadian-pharmaceuticals-online-08-12

Really all kinds of terrific tips.

tadalafil 5mg https://graph.org/Pharmacies-in-canada-shipping-to-usa-08-12

You revealed that really well!

canadian pharmacies https://telegra.ph/Recommended-canadian-pharmacies-08-12

Many thanks! Valuable information.

tadalafil 20 mg https://graph.org/Safe-canadian-online-pharmacies-08-12

Awesome tips. Cheers.

drugs for sale https://linktr.ee/canadianpharmacies

Many thanks! Numerous advice.

Viagra 20mg https://buyviagraonlinee.mystrikingly.com/

Information clearly used!!

Viagra online https://buyviagraonline.estranky.sk/clanky/buy-viagra-without-prescription-pharmacy-online.html

Awesome forum posts. Kudos.

canadian cialis https://buyviagraonline.flazio.com/

Incredible quite a lot of useful advice.

cialis generic https://buyviagraonline.fo.team/

Wow loads of awesome data.

buy cialis https://noyano.wixsite.com/buyviagraonline

You actually expressed it terrifically.

Viagra 20 mg best price https://buyviagraonlinet.wordpress.com/

With thanks. Quite a lot of content.

Tadalafil 20 mg https://buyviagraonl.livejournal.com/386.html

Nicely put. Appreciate it.

cialis prices https://buyviagraonline.nethouse.ru/

You said it adequately.!

buy cialis online https://buyviagraonline.estranky.cz/clanky/can-i-buy-viagra-without-prescription.html

Terrific forum posts, With thanks!

Buy viagra online https://buyviagraonline.proweb.cz/

Thanks a lot! Ample write ups.

cialis online https://buyviagraonline.zombeek.cz/

Kudos, Quite a lot of knowledge!

Low cost viagra 20mg http://jso7c59f304.iwopop.com/

Great knowledge. Thanks a lot!

cialis 20 mg https://buyviagraonline.bigcartel.com/viagra-without-a-doctor-prescription

Cheers. Ample postings!

medication without a doctors prescription https://buyviagraonline.teachable.com/

You revealed it well!

buy cialis https://telegra.ph/How-to-get-viagra-without-a-doctor-08-18

You actually said it wonderfully.

cialis generico https://graph.org/Buying-viagra-without-a-prescription-08-18

Really many of superb information.

medication without a doctors prescription https://buyviagraonline.micro.blog/

You stated that fantastically!

Viagra pills https://my.desktopnexus.com/buyviagraonline/journal/online-viagra-without-a-prescriptuon-38932/

Fantastic material. Kudos!

Viagra generique https://www.divephotoguide.com/user/buyviagraonline

You said it adequately.!

cialis tablets https://hub.docker.com/r/buyviagraonline/viagra

You actually said this very well.

tadalafil generic https://viagrawithoutprescription.webflow.io/

With thanks. I appreciate it!

online prescriptions without a doctor https://form.jotform.com/222341315941044

You actually reported it exceptionally well.

Viagra for sale https://linktr.ee/buyviagraonline

Wonderful write ups. Thanks.

Viagra pills https://buyviagraonline.home.blog/

Appreciate it. A good amount of information!

cialis canada https://canadianpharmaceuticalsonline.home.blog/

This is nicely put! !

medication without a doctors prescription https://onlineviagra.mystrikingly.com/

Cheers. Lots of facts!

Viagra 20 mg best price https://reallygoodemails.com/onlineviagra

Factor certainly taken..

cialis pills https://viagraonline.estranky.sk/clanky/viagra-without-prescription.html

Wonderful content, With thanks.

cialis canada https://viagraonlineee.wordpress.com/

You actually explained it very well.

cialis generico https://viagraonline.home.blog/

With thanks! Quite a lot of posts!

Tadalafil https://viagraonlinee.livejournal.com/492.html

Thanks a lot! Ample facts!

cialis 5mg https://onlineviagra.flazio.com/

This is nicely put. .

tadalafil 20 mg https://onlineviagra.fo.team/

You actually expressed it wonderfully!

cialis 5mg https://www.kadenze.com/users/canadian-pharmaceuticals-for-usa-sales

Incredible many of beneficial information!

cialis online https://linktr.ee/canadianpharmaceuticalsonline

Good write ups, With thanks.

canadian pharmacies shipping to usa https://disqus.com/home/forum/canadian-pharmaceuticals-online/

You mentioned it fantastically.

canada pharmacies https://500px.com/p/canadianpharmaceuticalsonline

Terrific posts. Thanks.

cialis from canada https://dailygram.com/index.php/blog/1155353/we-know-quite-a-bit-about-covid-19/

Kudos. Lots of information.

canadianpharmacy https://challonge.com/en/canadianpharmaceuticalsonlinemt

Excellent forum posts. Thanks.

cialis 5mg https://500px.com/p/listofcanadianpharmaceuticalsonline

Whoa all kinds of good facts.

most reliable canadian pharmacies https://www.seje.gov.mz/question/canadian-pharmacies-shipping-to-usa/

Amazing all kinds of good info!

tadalafil generic https://challonge.com/en/canadianpharmaciesshippingtousa

Great postings. Appreciate it!

cialis 5mg https://challonge.com/en/canadianpharmaceuticalsonlinetousa

Superb tips. Many thanks.

cialis generico online https://pinshape.com/users/2441403-canadian-pharmaceuticals-online

Thanks, Ample advice!

online cialis https://www.scoop.it/topic/canadian-pharmaceuticals-online

You reported that superbly.

cialis uk https://reallygoodemails.com/canadianpharmaceuticalsonline

Useful facts. Regards.

canadian rx world pharmacy pinshape.com/users/2441621-canadian-pharmaceutical-companies

Whoa lots of very good information.

tadalafil 20mg https://pinshape.com/users/2441621-canadian-pharmaceutical-companies

Nicely put. Thank you!

tadalafil https://reallygoodemails.com/canadianpharmaceuticalcompanies

Nicely put. Thank you.

discount stromectol https://pinshape.com/users/2445987-order-stromectol-over-the-counter

Whoa loads of superb data.

Buy viagra online https://reallygoodemails.com/orderstromectoloverthecounter

Truly a lot of useful advice!

Viagra coupon https://challonge.com/en/orderstromectoloverthecounter

Nicely put. Thanks.

Viagra vs viagra https://500px.com/p/orderstromectoloverthecounter

Very good knowledge. Thank you.

How does viagra work https://www.seje.gov.mz/question/order-stromectol-over-the-counter-6/

Cheers. An abundance of write ups!

buy stromectol online fitndance https://canadajobscenter.com/author/buystromectol/

Nicely put. Many thanks!

Viagra pills https://canadajobscenter.com/author/canadianpharmaceuticalsonline/

Thanks a lot, Lots of forum posts!

Viagra 5 mg https://aoc.stamford.edu/profile/canadianpharmaceuticalsonline/

You mentioned it fantastically!

Generic viagra https://canadianpharmaceuticalsonline.bandcamp.com/releases

Great postings. Thank you.

Tadalafil 20 mg https://ktqt.ftu.edu.vn/en/question list/canadian-pharmaceuticals-for-usa-sales/

Many thanks! Wonderful stuff.

Viagra generique https://www.provenexpert.com/canadian-pharmaceuticals-online/

Good posts. Many thanks.

Viagra uk https://aoc.stamford.edu/profile/Stromectol/

Valuable content. With thanks.

Viagra reviews https://ktqt.ftu.edu.vn/en/question list/order-stromectol-over-the-counter-10/

Nicely put. Appreciate it!

Viagra from canada https://orderstromectoloverthecounter.bandcamp.com/releases

Amazing loads of good material!

buying stromectol online https://www.provenexpert.com/order-stromectol-over-the-counter12/

Nicely put, Thank you.

Viagra reviews https://www.repairanswers.net/question/order-stromectol-over-the-counter-2/

Cheers. Valuable stuff.

Viagra generico https://www.repairanswers.net/question/stromectol-order-online/

Nicely put, With thanks.

stromectol for sale online https://canadajobscenter.com/author/arpreparof1989/

You have made your position very effectively.!

stromectol brasilien https://aoc.stamford.edu/profile/goatunmantmen/

You actually mentioned this terrifically!

Viagra canada https://web904.com/stromectol-buy/

This is nicely expressed! .

how much does stromectol cost https://web904.com/buy-ivermectin-online-fitndance/

Useful knowledge. Thanks.

stromectol pills https://glycvimepedd.bandcamp.com/releases

You mentioned this effectively.

canadian prescription drugstore https://canadajobscenter.com/author/ereswasint/

Wow a good deal of fantastic data!

Viagra generico https://aoc.stamford.edu/profile/hispennbackwin/

You actually reported this wonderfully.

online canadian pharmacy https://bursuppsligme.bandcamp.com/releases

Amazing content, Cheers!

canadian pharmacy online 24 https://pinshape.com/users/2461310-canadian-pharmacies-shipping-to-usa

You reported it very well!

Buy viagra online https://pinshape.com/users/2462760-order-stromectol-over-the-counter

Kudos! I value this.

Buy viagra https://pinshape.com/users/2462910-order-stromectol-online

Beneficial information. With thanks!

Viagra rezeptfrei 500px.com/p/phraspilliti

You actually mentioned it perfectly.

Buy generic viagra https://web904.com/canadian-pharmaceuticals-for-usa-sales/

Great knowledge. Many thanks!

ivermectina dosis https://500px.com/p/skulogovid/?view=groups

Wow a good deal of excellent material!

canadian pharmaceuticals https://500px.com/p/bersavahi/?view=groups

You expressed it superbly.

canadian pharmacy meds https://reallygoodemails.com/canadianpharmaceuticalsonlineusa

Regards. Plenty of data!

Viagra levitra https://www.provenexpert.com/canadian-pharmaceuticals-online-usa/

Fantastic information. Regards!

Viagra rezeptfrei https://sanangelolive.com/members/pharmaceuticals

Seriously a good deal of excellent knowledge.

Tadalafil https://melaninterest.com/user/canadian-pharmaceuticals-online/?view=likes

Truly tons of amazing tips.

Viagra cost https://haikudeck.com/canadian-pharmaceuticals-online-personal-presentation-827506e003

Reliable postings. Many thanks.

drugs for sale https://buyersguide.americanbar.org/profile/420642/0

Cheers, Good stuff!

Viagra purchasing https://experiment.com/users/canadianpharmacy

Amazing plenty of very good data!

pharmacy https://slides.com/canadianpharmaceuticalsonline

Reliable tips. With thanks.

buy generic stromectol https://challonge.com/esapenti

You explained it perfectly.

Viagra purchasing https://challonge.com/gotsembpertvil

Many thanks, Fantastic information.

How does viagra work https://challonge.com/citlitigolf

Awesome info. Thanks a lot.

Viagra bula https://order-stromectol-over-the-counter.estranky.cz/clanky/order-stromectol-over-the-counter.html

Point nicely regarded!!

Online viagra https://soncheebarxu.estranky.cz/clanky/stromectol-for-head-lice.html

Incredible lots of very good advice!

Viagra online https://lehyriwor.estranky.sk/clanky/stromectol-cream.html

Well voiced genuinely. .

Viagra 20 mg https://dsdgbvda.zombeek.cz/

Regards, I enjoy this!

Viagra tablets australia https://inflavnena.zombeek.cz/

Wonderful forum posts. Appreciate it.

canadian pharmacy https://www.myscrsdirectory.com/profile/421708/0

Truly all kinds of superb material.

prescriptions from canada without https://supplier.ihrsa.org/profile/421717/0

Nicely put. Thank you.

Viagra canada https://wefbuyersguide.wef.org/profile/421914/0

Truly a lot of wonderful facts!

Viagra levitra https://legalmarketplace.alanet.org/profile/421920/0

Nicely put. Kudos!

Viagra kaufen https://moaamein.nacda.com/profile/422018/0

Truly lots of excellent facts!

Viagra generico https://www.audiologysolutionsnetwork.org/profile/422019/0

Wow a lot of amazing tips!

Viagra rezeptfrei https://network.myscrs.org/profile/422020/0

Cheers! I enjoy this!

Viagra generico https://sanangelolive.com/members/canadianpharmaceuticalsonlineusa

Very well spoken genuinely! .

Tadalafil 5mg https://sanangelolive.com/members/girsagerea

Thanks a lot, A good amount of tips.

Viagra 20 mg https://www.ecosia.org/search?q=“My Canadian Pharmacy – Extensive Assortment of Medications – 2022”

You actually explained this very well.

highest rated canadian pharmacies https://www.mojomarketplace.com/user/Canadianpharmaceuticalsonline-EkugcJDMYH

Great stuff, Kudos.

Viagra vs viagra https://seedandspark.com/user/canadian-pharmaceuticals-online

Fine knowledge. With thanks.

canadian pharmacy king https://www.giantbomb.com/profile/canadapharmacy/blog/canadian-pharmaceuticals-online/265652/

Regards, Wonderful information.

canadian pharmacy online 24 https://feeds.feedburner.com/bing/Canadian-pharmaceuticals-online

Nicely put. Thank you!

Viagra vs viagra vs levitra https://search.gmx.com/web/result?q=“My Canadian Pharmacy – Extensive Assortment of Medications – 2022”

Very good stuff. Thanks a lot.

pharmacy https://search.seznam.cz/?q=“My Canadian Pharmacy – Extensive Assortment of Medications – 2022”

Many thanks! Loads of postings!

Viagra sans ordonnance https://sanangelolive.com/members/unsafiri

Cheers! An abundance of facts.

Viagra 5 mg

Good advice. Thanks a lot.

Tadalafil 20 mg https://swisscows.com/en/web?query=“My Canadian Pharmacy – Extensive Assortment of Medications – 2022”

You said this wonderfully!

canadadrugs https://www.dogpile.com/serp?q=“My Canadian Pharmacy – Extensive Assortment of Medications – 2022”

Nicely put, Cheers.

Cheap viagra

Seriously quite a lot of superb material!

Interactions for viagra https://search.givewater.com/serp?q=“My Canadian Pharmacy – Extensive Assortment of Medications – 2022”

Really plenty of valuable knowledge.

Tadalafil tablets https://www.bakespace.com/members/profile/Сanadian pharmaceuticals for usa sales/1541108/

Superb posts. Appreciate it!

Cheap viagra

You reported this exceptionally well.

Viagra great britain https://results.excite.com/serp?q=“My Canadian Pharmacy – Extensive Assortment of Medications – 2022”

Incredible a lot of useful data.

Cheap viagra https://www.infospace.com/serp?q=“My Canadian Pharmacy – Extensive Assortment of Medications – 2022”

Many thanks, I appreciate it.

Viagra manufacturer coupon https://headwayapp.co/canadianppharmacy-changelog

You expressed it perfectly.

Tadalafil 20 mg https://results.excite.com/serp?q=“My Canadian Pharmacy – Extensive Assortment of Medications – 2022”

Whoa a lot of good material.

canadian prescription drugstore https://canadianpharmaceuticalsonline.as.me/schedule.php

Nicely put. Cheers.

Viagra uk https://feeds.feedburner.com/bing/stromectolnoprescription

Lovely information. Appreciate it.

5 mg viagra coupon printable https://reallygoodemails.com/orderstromectoloverthecounterusa

Useful data. Thank you.

ivermectin for humans https://aoc.stamford.edu/profile/cliclecnotes/

Nicely put. Thank you!

generic stromectol https://pinshape.com/users/2491694-buy-stromectol-fitndance

Kudos! I value it!

order stromectol online https://www.provenexpert.com/medicament-stromectol/

Helpful postings. Many thanks.

Viagra tablets australia https://challonge.com/bunmiconglours

Really quite a lot of amazing facts!

stromectol pharmacokinetics https://theosipostmouths.estranky.cz/clanky/stromectol-biam.html

Very well spoken really. .

Viagra manufacturer coupon https://tropkefacon.estranky.sk/clanky/buy-ivermectin-fitndance.html

You’ve made your stand extremely well.!

Viagra vs viagra vs levitra https://www.midi.org/forum/profile/89266-canadianpharmaceuticalsonline

Seriously lots of helpful facts.

Tadalafil https://dramamhinca.zombeek.cz/

Very good data. Cheers!

Viagra sans ordonnance https://sanangelolive.com/members/thisphophehand

You explained this effectively.

Buy viagra https://motocom.co/demos/netw5/askme/question/canadian-pharmaceuticals-online-5/

Very good posts. Regards.

Viagra from canada https://www.infospace.com/serp?q=“My Canadian Pharmacy – Extensive Assortment of Medications – 2022”

Really a lot of helpful info.

Viagra manufacturer coupon https://zencastr.com/@pharmaceuticals

Info effectively considered!!

Viagra canada https://aleserme.estranky.sk/clanky/stromectol-espana.html

Many thanks. I enjoy this!

Viagra tablets https://orderstromectoloverthecounter.mystrikingly.com/

Truly a lot of terrific material!

stromectol demodex https://stromectoloverthecounter.wordpress.com/

You suggested it terrifically.

Viagra generic https://buystromectol.livejournal.com/421.html

Very good advice. With thanks!

order stromectol over the counter https://orderstromectoloverthecounter.flazio.com/

Cheers! Numerous posts!

online drug store https://search.lycos.com/web/?q=“My Canadian Pharmacy – Extensive Assortment of Medications – 2022”

You actually suggested it well!

northwest pharmacies https://conifer.rhizome.org/pharmaceuticals

With thanks! Lots of write ups!

Viagra levitra https://telegra.ph/Order-Stromectol-over-the-counter-10-29

With thanks, Excellent information.

Viagra purchasing https://graph.org/Order-Stromectol-over-the-counter-10-29-2

Thanks! A good amount of info.

is stromectol safe https://orderstromectoloverthecounter.fo.team/

Incredible tons of awesome advice!

stromectol cvs https://orderstromectoloverthecounter.proweb.cz/

Really tons of excellent data!

buying stromectol https://orderstromectoloverthecounter.nethouse.ru/

Kudos, Quite a lot of write ups!

Viagra generique https://sandbox.zenodo.org/communities/canadianpharmaceuticalsonline/

With thanks, Terrific stuff.

viagra canada https://demo.socialengine.com/blogs/2403/1227/canadian-pharmaceuticals-online

You said that wonderfully.

canadian pharmacy viagra https://pharmaceuticals.cgsociety.org/jvcc/canadian-pharmaceuti

You definitely made the point!

Discount viagra https://taylorhicks.ning.com/photo/albums/best-canadian-pharmaceuticals-online

Valuable tips. Regards.

canadian pharmacy cialis https://my.afcpe.org/forums/discussion/discussions/reputable-canadian-pharmaceuticals-online

Nicely put. Thank you!

canadian discount pharmacies https://www.dibiz.com/ndeapq

Seriously all kinds of useful data!

Viagra or viagra https://www.podcasts.com/canadian-pharmacies-shipping-to-usa

Really lots of superb tips.

Generic for viagra https://canadianpharmaceuticals.educatorpages.com/pages/canadian-pharmacies-shipping-to-usa

Kudos, I value it.

canadianpharmacy https://soundcloud.com/canadian-pharmacy

Appreciate it! Quite a lot of information!

canada medication https://peatix.com/user/14373921/view

Regards! Plenty of write ups.

Viagra 5 mg funziona https://www.cakeresume.com/me/best-canadian-pharmaceuticals-online

You actually revealed this exceptionally well.

Viagra 5mg prix https://dragonballwiki.net/forum/canadian-pharmaceuticals-online-safe/

Regards, I value this!

Viagra purchasing https://the-dots.com/projects/covid-19-in-seven-little-words-848643

You reported it exceptionally well!

Generic viagra https://jemi.so/canadian-pharmacies-shipping-to-usa

Thanks a lot. I value this.

Viagra dosage https://www.homify.com/ideabooks/9099923/reputable-canadian-pharmaceuticals-online

Thank you. I appreciate this.

Buy viagra https://medium.com/@pharmaceuticalsonline/canadian-pharmaceutical-drugstore-2503e21730a5

Helpful stuff. Thanks.

canadian pharmacy no prescription https://infogram.com/canadian-pharmacies-shipping-to-usa-1h1749v1jry1q6z

Nicely put. With thanks.

Viagra 5 mg https://pinshape.com/users/2507399-best-canadian-pharmaceuticals-online

You actually stated that perfectly!

Viagra daily https://aoc.stamford.edu/profile/upogunem/

You reported this very well!

Viagra 5mg https://500px.com/p/maybenseiprep/?view=groups

You actually reported that effectively!

Viagra dosage https://challonge.com/ebtortety

Perfectly expressed really. .

Interactions for viagra https://sacajegi.estranky.cz/clanky/online-medicine-shopping.html

Amazing plenty of excellent info.

canadian pharmacies online https://speedopoflet.estranky.sk/clanky/international-pharmacy.html

Wow lots of excellent info.

most reliable canadian pharmacies https://dustpontisrhos.zombeek.cz/

Wonderful stuff. With thanks.

Viagra 5 mg https://sanangelolive.com/members/maiworkgendty

Kudos. A lot of data!

Viagra vs viagra vs levitra https://issuu.com/lustgavalar

Regards! I value it!

best canadian pharmacy https://calendly.com/canadianpharmaceuticalsonline/onlinepharmacy

Reliable data. Kudos!

Viagra 5 mg https://aoc.stamford.edu/profile/uxertodo/

You actually mentioned that exceptionally well!

Buy viagra https://www.wattpad.com/user/Canadianpharmacy

You suggested that perfectly.

Viagra cost https://pinshape.com/users/2510246-medicine-online-shopping

Awesome info. Thanks.

legitimate canadian mail order pharmacies https://500px.com/p/reisupvertketk/?view=groups

With thanks, Useful stuff!

Discount viagra https://www.provenexpert.com/online-order-medicine/

Good material. Kudos!

canadian pharmacies without an rx https://challonge.com/ebocivid

You said it adequately.!

Viagra lowest price https://obsusilli.zombeek.cz/

You’ve made your stand quite nicely.!

cialis canadian pharmacy https://sanangelolive.com/members/contikegel

Incredible a lot of valuable facts!

canadian pharmacy no prescription https://rentry.co/canadianpharmaceuticalsonline

You actually reported it effectively!

no 1 canadian pharcharmy online https://tawk.to/canadianpharmaceuticalsonline

Thanks, I enjoy this.

Viagra levitra https://canadianpharmaceuticalsonline.tawk.help/article/canadian-pharmacies-shipping-to-usa

Wow all kinds of beneficial advice!

Viagra online https://sway.office.com/bwqoJDkPTZku0kFA

Reliable knowledge. Thanks a lot!

Online viagra https://canadianpharmaceuticalsonline.eventsmart.com/2022/11/20/canadian-pharmaceuticals-for-usa-sales/

Whoa a lot of fantastic knowledge.

Viagra rezeptfrei https://suppdentcanchurch.estranky.cz/clanky/online-medicine-order-discount.html

Many thanks. Terrific information!

safe canadian online pharmacies https://aoc.stamford.edu/profile/tosenbenlren/

Beneficial forum posts. Appreciate it!

Viagra 20mg https://pinshape.com/users/2513487-online-medicine-shopping

Kudos! Good information.

Viagra pills https://500px.com/p/meyvancohurt/?view=groups

This is nicely put! !

Viagra tablets https://www.provenexpert.com/pharmacy-online/

Regards. Numerous knowledge.

Viagra generika https://challonge.com/townsiglutep

Really a lot of superb tips!

cialis canadian pharmacy https://appieloku.estranky.cz/clanky/online-medicine-to-buy.html

You made the point!

Viagra rezeptfrei https://scisevitrid.estranky.sk/clanky/canada-pharmacies.html

Cheers. Useful information!

Viagra tablets australia https://brujagflysban.zombeek.cz/

Awesome tips. Thanks.

Viagra purchasing https://aoc.stamford.edu/profile/plumerinput/

Seriously quite a lot of amazing information!

Viagra vs viagra https://500px.com/p/stofovinin/?view=groups

Excellent data. Thanks!

Viagra for daily use https://challonge.com/afersparun

Well voiced truly. !

solutions to erectile dysfunction https://plancaticam.estranky.cz/clanky/best-drugs-for-ed.html

Appreciate it. Loads of advice.

Viagra or viagra https://piesapalbe.estranky.sk/clanky/buy-erectile-dysfunction-medications-online.html

Many thanks, A good amount of knowledge.

Viagra generika https://wallsawadar.zombeek.cz/

Superb information. Thanks a lot.

Discount viagra https://www.cakeresume.com/me/canadian-pharmaceuticals-online/

You suggested it well!

cialis from canada https://canadianpharmaceuticalsonline.studio.site/

You actually mentioned it very well.

Viagra 20mg https://en.gravatar.com/canadianpharmaceuticalcompanies

You actually mentioned it well.

Viagra 5 mg funziona https://www.viki.com/users/pharmaceuticalsonline/about

Great write ups, Thanks!

canadian pharmacies without an rx https://canadianpharmaceuticalsonline.blog.jp/archives/19372004.html

Tips certainly regarded..

Viagra tablets https://canadianpharmaceuticalsonline.doorblog.jp/archives/19385382.html

Factor very well taken!.

canadian online pharmacy https://canadianpharmaceuticalsonline.ldblog.jp/archives/19386301.html

Lovely material. Many thanks.

Viagra uk https://canadianpharmaceuticalsonline.dreamlog.jp/archives/19387310.html

Wow a lot of helpful material.

Online viagra https://canadianpharmaceuticalsonline.publog.jp/archives/16846649.html

Wow a lot of helpful data.

How does viagra work https://canadianpharmaceuticalsonline.livedoor.biz/archives/17957096.html

Cheers. An abundance of stuff!

5 mg viagra coupon printable https://canadianpharmaceuticalsonline.diary.to/archives/16857199.html

With thanks. I enjoy it.

Buy generic viagra https://canadianpharmaceuticalsonline.weblog.to/archives/19410199.html

Whoa many of very good information!

canadian drugstore https://canadianpharmaceuticalsonline.bloggeek.jp/archives/16871680.html

You have made your stand extremely well!!

5 mg viagra coupon printable https://canadianpharmaceuticalsonline.blogism.jp/archives/17866152.html

This is nicely put! .

Viagra 20mg https://canadianpharmaceuticalsonline.blogo.jp/archives/19436771.html

Great facts. Many thanks!

Buy viagra https://canadianpharmaceuticalsonline.blogto.jp/archives/19498043.html

With thanks, I like this.

northwest pharmacies https://canadianpharmaceuticalsonline.gger.jp/archives/18015248.html

Thanks. I enjoy it!

Viagra rezeptfrei https://canadianpharmaceuticalsonline.golog.jp/archives/16914921.html

Thanks, I appreciate this.

Viagra lowest price https://canadianpharmaceuticalsonline.liblo.jp/archives/19549081.html

You actually stated this wonderfully.

online pharmacy https://canadianpharmaceuticalsonline.myjournal.jp/archives/18054504.html

Nicely put, Cheers.

online pharmacies canada https://canadianpharmaceuticalsonline.mynikki.jp/archives/16957846.html

Valuable posts. Regards.

Viagra generic https://pinshape.com/users/2528098-canadian-pharmacy-online

Truly a good deal of very good information.

Tadalafil tablets https://gravatar.com/kqwsh

You expressed that fantastically.

Viagra generika https://www.buymeacoffee.com/pharmaceuticals

You’ve made the point!

buy viagra now https://telegra.ph/Canadian-pharmacy-drugs-online-12-11

Very well spoken really! .

Viagra generico online https://graph.org/Canadian-pharmacies-online-12-11

Amazing loads of terrific knowledge!

How does viagra work https://canadianonlinepharmacieslegitimate.flazio.com/

Terrific data. Appreciate it.

drugstore online https://halttancentnin.livejournal.com/301.html

You actually revealed this terrifically.

Viagra dosage https://app.roll20.net/users/11413335/canadian-pharmaceuticals-online-shipping

Regards! I value it!

Viagra canada https://linktr.ee/canadianpharmaceuticalsonlineu

Really tons of terrific facts!

canadadrugs https://onlinepharmaciesofcanada.bigcartel.com/best-canadian-online-pharmacy

Whoa plenty of terrific knowledge.

canadian drugstore https://hub.docker.com/r/canadadiscountdrug/pharmaceuticals

This is nicely expressed! !

canadian mail order pharmacies https://pharmacy-online.teachable.com/

Fine information. Kudos!

Viagra vs viagra https://experiment.com/users/canadiandrugs/

Great information, Regards.

Viagra canada https://disqus.com/by/canadiandrugspharmacy/about/

Whoa all kinds of very good material.

Viagra vs viagra https://offcourse.co/users/profile/best-online-canadian-pharmacy

This is nicely put! !

Viagra prices https://bitcoinblack.net/community/canadianpharmacyonlineviagra/info/

Thanks. Useful information!

Viagra generika https://forum.melanoma.org/user/canadadrugsonline/profile/

Nicely put. Thanks a lot!

Viagra 5 mg https://wakelet.com/@OnlinepharmacyCanadausa

Kudos. Terrific stuff.

Viagra 20 mg https://www.divephotoguide.com/user/canadadrugspharmacyonline

You suggested this adequately!

Viagra great britain https://my.desktopnexus.com/Canadianpharmacygeneric/journal/

Wow lots of good information!

Viagra from canada http://canadianpharmaceuticalsonlinee.iwopop.com/

Seriously a lot of superb tips.

top rated online canadian pharmacies https://datastudio.google.com/reporting/1e2ea892-3f18-4459-932e-6fcd458f5505/page/MCR7C

Useful advice. Thank you.

Viagra 20mg https://pharmacycheapnoprescription.nethouse.ru/

Cheers. An abundance of content!

canadian pharmacy cialis https://www.midi.org/forum/profile/96944-pharmacyonlinecheap

You reported that really well!

Viagra from canada https://www.provenexpert.com/canadian-pharmacy-viagra-generic2/

You revealed this superbly.

Viagra sans ordonnance https://dailygram.com/blog/1183360/canada-online-pharmacies/

You said it perfectly.!

Viagra purchasing https://bitbucket.org/canadianpharmaceuticalsonline/workspace/snippets/k7KRy4

Good facts. Appreciate it!

Viagra for daily use https://rabbitroom.com/members/onlinepharmacydrugstore/profile/

You actually explained this terrifically!

Viagra tablets australia https://www.mixcloud.com/canadianpharmaceuticalsonline/

Nicely put, Appreciate it.

canada rx https://sketchfab.com/canadianpharmaceuticalsonline

Amazing lots of wonderful information.

canadian pharmacies without an rx https://fliphtml5.com/homepage/fhrha

Really tons of wonderful advice!

Viagra levitra https://www.goodreads.com/user/show/161146330-canadianpharmaceuticalsonline

Fantastic data. Many thanks.

Viagra reviews https://myanimelist.net/profile/canadapharmacies

Seriously plenty of wonderful data!

Viagra levitra https://pharmacyonlineprescription.webflow.io/

With thanks. Quite a lot of stuff!

Viagra from canada https://www.isixsigma.com/members/pharmacyonlinenoprescription/

Thanks a lot! Loads of forum posts!

canadian prescription drugstore https://slides.com/bestcanadianonlinepharmacies

You actually mentioned it terrifically!

pharmacy https://www.mojomarketplace.com/user/discountcanadiandrugs-f0IpYCKav8

Amazing postings. Regards!

safe canadian online pharmacies https://canadianpharmaceuticalsonlinee.bandcamp.com/track/canadian-pharmaceuticals-usa

You explained this fantastically.

Discount viagra https://www.askclassifieds.com/listing/aarp-recommended-canadian-pharmacies/

You revealed this terrifically.

Viagra 5mg prix https://www.gamespace.com/members/canadianprescriptionsonline/

Valuable posts. Cheers!

Viagra levitra https://haikudeck.com/presentations/canadianpharmacies

Nicely put. Thanks.

Viagra cost https://www.bakespace.com/members/profile/Viagra generic online Pharmacy/1562809/

Wow loads of terrific advice.

Viagra 5mg https://conifer.rhizome.org/Discountpharmacy

Incredible all kinds of excellent material!

highest rated canadian pharmacies https://haikudeck.com/presentations/cheapprescriptiondrugs

You said it adequately..

Viagra prices https://experiment.com/users/pviagrapharmacy100mg

Info effectively regarded.!

canada pharmacies online https://slides.com/canadianpharmacycialis20mg

Wonderful info. Appreciate it.

Viagra alternative https://www.mojomarketplace.com/user/genericviagraonline-A1mET2hm7S

You suggested this adequately!

Generic viagra https://seedandspark.com/user/buy-viagra-pharmacy-100mg/

You expressed that wonderfully.

Viagra reviews https://www.giantbomb.com/profile/reatticamic/blog/canadian-government-approved-pharmacies/268967/

Really a good deal of amazing information!

online pharmacy https://www.bakespace.com/members/profile/Canadian drugs online pharmacies/1563583/

You expressed this well.

Viagra vs viagra https://www.midi.org/forum/profile/100747-canadian-drugs-pharmacies-online

Thanks a lot! I like this.

buy viagra usa https://sandbox.zenodo.org/communities/cialisgenericpharmacyonline/about/

Amazing material. Thank you!

Viagra tablets australia https://cialispharmacy.cgsociety.org/profile

Appreciate it, Quite a lot of info.

Viagra generique https://fnote.net/notes/7ce1ce

You actually said that terrifically.

Low cost viagra 20mg https://taylorhicks.ning.com/photo/albums/pharmacies-shipping-to-usa

Useful facts. Many thanks.

Viagra purchasing https://my.afcpe.org/forums/discussion/discussions/canadian-pharmacy-drugs-online

Thanks! An abundance of advice.